You may have heard of or have used TransferWise for moving money to Portugal or another country, but did you know you can also get an account with them? In this article, I will talk about one of their major services: A TransferWise Borderless Account which was launched in 2017. I will discuss how it works in Portugal, the benefits and some disadvantages of using the TransferWise Borderless Account.

What is a TransferWise Borderless Account?

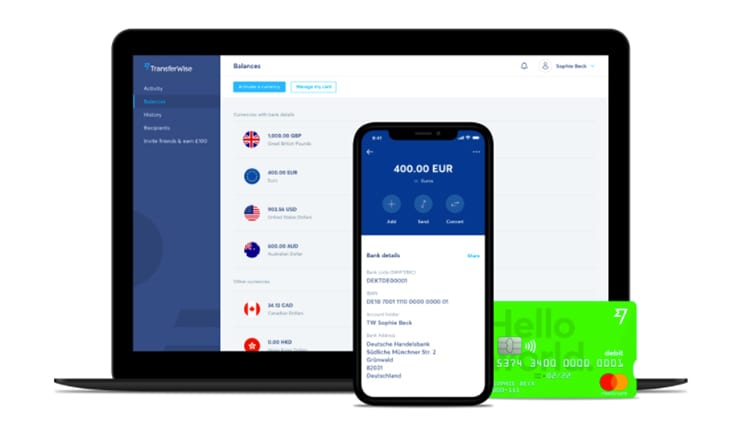

TransferWise was founded in 2011 and has become a major company in the financial sector worldwide. As the name implies, the TransferWise Borderless Account is an online account that transcends “financial boundaries” which traditional banks do not necessarily offer and if they do, it comes with a big transaction fee. The TransferWise Borderless Account allows you to create a bank account in euros, British pounds, US dollars, Australian dollars and New Zealand dollars without you having to live or have a bank account in any of those countries. I live in Portugal and I have a US and UK bank details on my TransferWise account where I can receive monies in those currencies just as if I am living in any of those countries. This basically gives me a local bank presence in the US, UK and the Eurozone. I personally find that very cool and amazing. The TransferWise Borderless Account also allows you to hold money in more than 40 currencies and exchange between these currencies at real-time exchange rates.

How does a TransferWise Borderless Account work?

A TransferWise Borderless Account simply put, helps you receive money in euros, British pounds, US dollars, Australian dollars and New Zealand dollars within your multi-currency borderless account without incurring any fees. And with your TransferWise debit card, you can hold money and spend it in any currency, anywhere in the world.

What are the TransferWise Borderless Account Fees?

Using the TransferWise Borderless Account doesn’t come with too many fees and when you are charged, the fees are usually low. Opening a TransferWise Borderless Account is free and you can receive up to five International bank details (AUD, EUR, GBP, USD, NZD) also for free without being locked into a monthly or annual fee subscription. Also receiving money with your international bank details in the local currency of your borderless bank details is equally free. For example, I receive money in my TransferWise USD account from people in the US without incurring any charges.

Some transactions incur a fee

However, not everything is free when using the TransferWise Borderless Account, you would incur some transaction fees when you do some of the following transactions:

Adding money to your balances

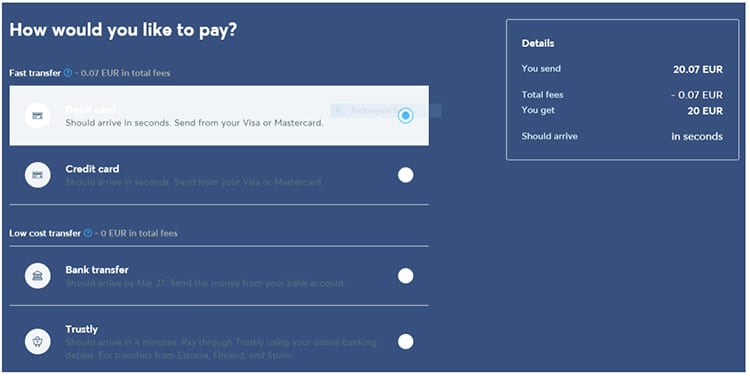

The fees incurred when adding money to your TransferWise Borderless Account is very minimal. For example, when I add €20 to my EUR account using the fast transfer option, I am charged only €0.07 cents. Alternatively, you can add money with zero fees using the “easy transfer” option, but your borderless account isn’t credited immediately. It takes two to three days for it to reflect in your TransferWise Borderless Account.

Converting between currencies in your account

When you convert from one currency to another in your TransferWise Borderless Account, you will be charged the conversion fees which are generally very small and much cheaper than a bank.

Sending money to a bank account

Finally, you will also incur some fees for sending money from your TransferWise Borderless Account to a bank account. However, it’s free to send money from one TransferWise Borderless Account to another. For more information on fees, check the TransferWise website here.

Which countries have TransferWise Borderless Accounts?

The TransferWise Borderless Account is available in Portugal and all other European countries and most countries around the world. However, it is not available in two states in the US (Hawaii and Nevada) and the following countries:

- Afghanistan;

- Brazil;

- Burundi;

- The Central African Republic;

- Chad;

- Congo Republic;

- Crimea (sub-territory);

- Cuba;

- The Democratic Republic of the Congo;

- Eritrea;

- Hong Kong;

- India;

- Iran;

- Iraq;

- Japan;

- Libya;

- North Korea;

- Sevastopol (city);

- Somalia;

- Republic of South Sudan;

- Sudan; and

- The Syrian Arab Republic.

Want to know more about managing your money in Portugal? Don’t miss out on all the latest articles by signing up for our FREE newsletter here.

Can I use the TransferWise Borderless Account in Portugal?

Yes, you can. The TransferWise MasterCard and Borderless Account work perfectly in Portugal. It is also totally legal and safe.

TransferWise Borderless Account limits

As of right now, there is no limit to the amount you can hold in the different currencies in your TransferWise Borderless Account except for the US dollar account. Below you will find the personal and business limits for using a TransferWise Borderless Account.

| Personal limit | Business limit | |

| All currencies except USD | No limit | No limit |

| USD standard limit * | $10,000 | $25,000 |

| USD limit, per transaction and per day | $250,000 | $3,000,000 |

| USD limit per year | $1,000,000 | $5,000,000 |

(*after these amounts, they need to ask you how you use your balance, and why you receive payments.) For more information about TransferWise Borderless Account limits please see TransferWise’s Support page here.

How to get a TransferWise Borderless Account and card

Creating a TransferWise Borderless Account and ordering a debit card on TransferWise is very easy to do. It requires just a few steps. It took me about five minutes to do it. Here are the steps to follow:

- Go to this my TransferWise page here (where you can send up to £500 for free!);

- Click on the “Sign up” button at the top-right of the page;

- Choose the type of account you want to create (Personal or Business);

- Fill in your email address and password and then click on “Sign up”. (You will receive an email to confirm your email address).

At this point, your account is set up but not verified.

How to verify your account

- Sign in with your email address and password;

- Click on the drop-down arrow at the top-right corner;

- Click on “Verification”;

- Click on “Create Profile”;

- Then fill in your details into the dialogue box;

- Click “Save” when you are done;

- Next, you will be prompted to upload a photo of your ID (passport or driver’s license) for your account to be verified.

My account was verified almost immediately, but they usually state it can take up to five working days to verify. Your TransferWise Borderless Account is all set up.

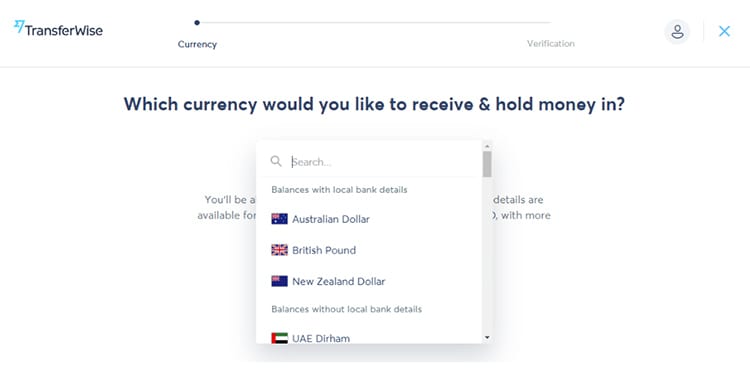

How to add a balance

Now, you can go ahead and add a balance to create accounts in other currencies you want. The current options available are USD, EUR GBP, AUD and NZD.

- Click on the balances icon on the left side of your page;

- Click on “Add balance”;

- Choose the currency of the account you wish to create;

- Click “Ok”. Immediately your account is set up in that currency.

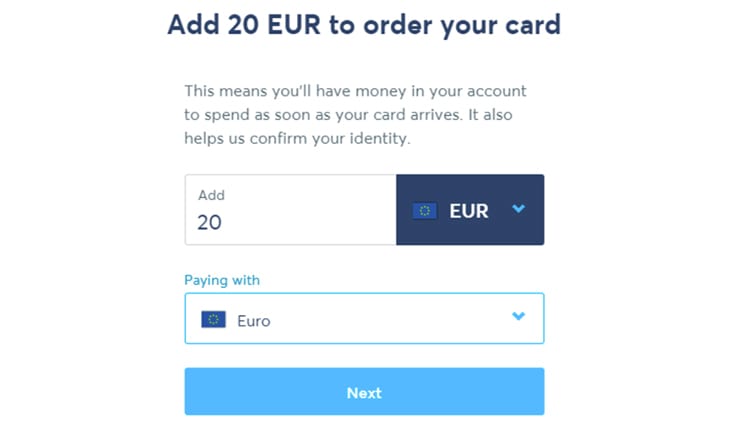

How to order the debit card

- Click on the debit card icon;

- Fill in your name and delivery address;

- You will have to top it up with a minimum of €20;

- Once you have completed the payment, you will receive an email saying that your card is being shipped to you.

You can top up with a credit card or other debit card and this way, your TransferWise Borderless Account is credited immediately. Alternatively, you can do a bank transfer which takes a few days to be credited into your new account.

After filling in your details, address and topping up your account, you should receive the card within six to eight working days. That’s all! Note: it is not compulsory to order a card when setting up the account. You should also know that the TransferWise debit card is currently only available to Europe-based personal customers. There is currently a beta version being tested for US-based customers.

Advantages and disadvantages of a TransferWise Borderless Account

These are the advantages of having a TransferWise Borderless Account:

- Local bank account details in multiple countries and currencies;

- Low-cost international money transfers;

- Free ATM withdrawals up to £200 or its equivalent in a month;

- No monthly or annual charges;

- Very easy to use to send and receive payments;

- Small conversion fee when you exchange currency, usually between 0.5% and 1%;

- Spend anywhere in the world at the real exchange rate with your TransferWise multi-currency debit card;

- It’s free to open a TransferWise Borderless Account; and

- The TransferWise debit card is free.

There are a few disadvantages:

- Adding money to the account with a credit card or debit card costs an additional fee;

- You don’t earn interest on the money saved in your TransferWise Borderless Account; and

- You cannot pay with a cheque into your TransferWise Borderless Account.

Accessing your TransferWise Borderless Account

The TransferWise Borderless Account can be accessed via the TransferWise mobile app (Apple Mobile and Android) as well as through the TransferWise website. They are very safe and easy to use. I generally use the mobile app more because I am always on the move. Also, when you use the app you won’t need to do the two-step login all the time, which requires you to log in with a code sent to your phone each time you want to log in. I would suggest this to people who change their phone numbers frequently, otherwise, I think it is a good security feature to have. If you think the TransferWise Borderless Account is for you, you can sign up via my TransferWise link here to set up your account and you can transfer of up to £500 without paying transfer fees. If you want to know more about how TransferWise works in Portugal, have a look at our article here.

Are there alternatives to TransferWise Borderless Accounts?

One alternative to the TransferWise Borderless Account, for me, is Revolut. This is one of the latest companies to launch in the fintech industry. They offer similar services to TransferWise, though they have some paid subscription accounts with some advantages. Please see our article on Revolut for more information about their services in Portugal. There are a few others which I have not used, but you can try them out, for example, N26 and Monese.

Is a TransferWise Borderless Account worth it?

There has been a steady increase in the number of fintech companies worldwide and these companies have revolutionized the financial services industry and helped to reduce the cost of international money transfers as well as providing cheaper alternatives for spending money abroad. Using the TransferWise Borderless Account is worth it if you receive money regularly from abroad especially from Europe or the United States. I would say it could be very useful for international students that receive money from their home countries. Also, it can be a useful banking solution for digital nomads, freelancers and expats. The exchange fees are generally very fair and you can spend the money easily using the TransferWise debit card or withdraw cash in local currencies with minimal charges as well as receive payments in the major currencies of the world. In all, a TransferWise Borderless Account is a welcome innovation in the fintech world as it is revolutionizing the means of transferring money internationally as well as exchanging currencies with ease, in ways we thought were previously unimaginable. Do you have any questions about a TransferWise Borderless Account? Ask me in the comments below. I’m happy to help.